Security returns, adjusted for market risk, contain risk premia that compensate for the exposure to active fund risk. The active fund risk premium of a security can be modeled as the product of its beta premium sensitivity and price for exposure to active fund risk. Both components change overtime and mutually reinforce each other in episodes of negative fund returns and asset outflows. This explains why securities with high exposure to active fund risk command high expected returns. Active fund risk premia are particularly prevalent in local EM bond markets, where on average 20% of securities are held by foreign institutional investors, many of which are sensitive to drawdowns. Empirical evidence confirms that bonds whose returns positively correlate with active fund returns command substantial premia. The highest premia and expected returns would be offered at times of large capital outflows.

The below summary is based on:

So, Inhwan, Giorgio Valente and Jason Wu (2019), “Local Currency Bond Returns in Emerging Economies and the Role of Foreign Investors“, HKIMR Working Paper No.10/2019.

Emphasis and cursive text have been added.

The post ties in with the SRSV summary on implicit subsidies, particularly the section on “the sources of implicit subsidies”.

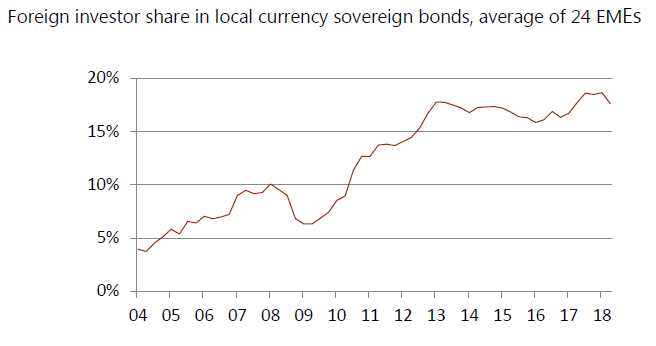

The importance of foreign funds in EM local-currency debt markets

“Local currency sovereign debt instruments issued by emerging economies (”EMEs”) have increased dramatically during the past two decades. By 2017, the amount of local currency sovereign debt reached almost US dollar 10 trillion. Foreign investors have been a major driver in the growth of such bonds: they now own about 20% of outstanding local currency sovereign debt, with some EMEs experiencing shares as high as 40%. Foreign institutional investors, in particular, play a substantial role, facilitated by the inclusion of EMEs debt securities in major tradable benchmarks and improved secondary market liquidity.”

“The growth of local currency bond markets in EMEs is an important institutional development that has accelerated after the 2008 global financial crisis…In the aftermath of the financial crisis, longer-term yields in advanced economies have declined consistently. Together with the fact that EMEs’ performed relatively well during the financial crisis, this has lead advanced economy investors to ‘reach-for-yield’…manifested in portfolio inflows…to EMEs. At the same time, because of currency mismatches over the past several decades, EME authorities have increasingly turned to issuing debt in local currencies as a way to mitigate sovereign default risk.”

“[Emerging markets] local currency bonds are purchased by advanced economies’ investment funds, such as open-ended mutual funds…For bond funds, the flows-performance relationship displays an asymmetry: outflows are more sensitive to bad performance than inflows to good performance. In the context of local currency EME bonds, the increased participation of foreign investors in the past decade suggests that the flows-performance relationship may be incorporated in bond returns in the form of higher risk premia.”

The theory of active fund risk premia

“In a market where active and passive investors co-exist, excess returns on risky asset are due to exposure to market risk and to exposure to potential losses originating from asset managed by active investors…Local-currency bond returns, adjusted for market risk, contain risk premia compensating for the exposure to active fund risk.”

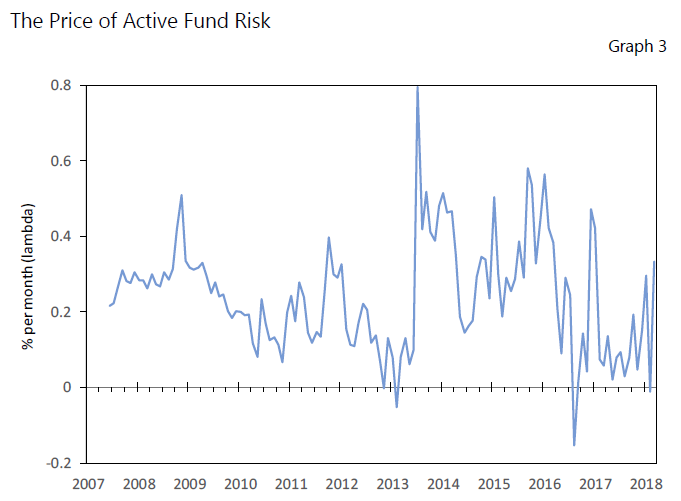

“The average bond excess return, or put differently its risk premium, is due to the product between the average price and quantity of active fund risk. Both variables…beta-premium sensitivity [which] measures the covariation between the price and quantity of active fund risk…[and] the price of active fund risk…change over time.”

“Beta-premium sensitivity is particularly important in this framework as it allows to capture the detrimental effect of capital outflows from EMEs in bad times. In fact, local currency bonds with positive beta-premium sensitivities exhibit high risk precisely when the active fund experiences negative returns and large outflows. This is the time when investors dislike risk and the price of risk is high. Hence, these bonds earn higher average returns than the ones with low or negative beta-premium sensitivity.”

Evidence of active fund risk premia in EM local-currency debt markets

“Taking the view that the performance of foreign active portfolios may represent a source of risk, ‘active fund risk’, EME sovereign debt, we report and discuss the evidence that risk premia arise from the covariation between the returns of local currency bonds and the ones from foreign bond funds who actively manage their holdings. Our calculations, based on a panel of 16 local currency bonds spanning the sample period July 2007 – March 2018, show that bonds whose returns positively covary with the returns of active funds will see their price drop in bad times, as active funds exert price pressures when they are forced to liquidate their holdings. In addition, the price of active fund risk increases as fund outflows becomes larger: as fund outflows gather pace and as the price of active fund risk increases, the model predicts that the covariation between bond returns and fund returns increases, magnifying its effect on bond expected excess returns.”

“More specifically, two portfolios are formed at the end of each month: the H and L portfolios including the bond/countries exhibiting the highest and lowest exposure to active fund risk, respectively. This procedure is then repeated until the end of the sample…

- The average excess returns exhibited by the H portfolio are positive and significantly higher than the ones recorded for the L portfolio. While excess returns from H portfolio are all statistically significant at 1 percent level, excess returns computed for L portfolios are overall insignificantly different from zero. Hence, the resulting return differentials between H and L portfolios are large and significant. These results confirm…[that] bonds whose returns positively co-move with the ones of the active fund command a substantial premium…

- The portfolio containing bonds with the highest exposure to active fund risk exhibits a positive and statistically significant beta-premium sensitivity. Put differently, when outflows ensues, not only does the price of active fund risk increases, but also the exposure to active risk increases, meaning that certain countries suffer from a double and mutually reinforcing negative effect with bond prices dropping substantially and expected returns increasing to a larger extent.”

“We plot the time-series estimate of the price of risk…The price of active fund risk was relatively flat at around 20 basis points per month (per unit of beta) until the ‘Taper Tantrum’ episode in mid-2013. Then the large portfolio net outflows from EMEs shifted the price of risk from a value close to zero to 80 basis points. Since mid-2013 and until 2018, the price of active fund risk has remained higher on average at around 40 basis points per month until 2016 and it decreased afterwards. This pattern is indicative of a potential risk attitude shift around 2013 which led to a more cautious behaviour of market participants over the subsequent three years.”

“The results also suggest that local currency bonds with positive beta-premium sensitivities have high risk precisely when the active fund experiences negative returns and large outflows. This is the time when investors dislike risk and the price of this risk is high. Hence, these bonds are indeed the ones to earn higher average returns than the bonds with low or negative beta-premium sensitivity.”