When long-term government bond yields are low enough, further declines can ‘feed on themselves’. European insurance companies and pension funds are plausible catalysts. The duration gap between their liabilities and assets typically widens non-linearly when yields are low and compressed further, triggering sizeable duration extension flows.

Liquidity risk in European bond markets

There are signs of liquidity decline and liquidity illusion in euro area government bond markets. Citibank research suggests that liquidity risk is rising due to increased capital requirements for dealers, reduced market maker inventories, enhanced dealer transparency rules, elevated assets under management of bond funds, and the liquidity transformation provided by these funds.

Commodity trading strategies and convenience yields

Convenience yield can be interpreted as a leasing rate for physical commodities. Returns on convenience claims are premia earned by investment strategies for providing this leasing service. An empirical analysis suggests that they depend on risk factors related to other asset classes, however. The inertia in these risk factors seems to help predicting returns on convenience claims.

The toxic combination of leverage and bubbles

A 145-year empirical analysis suggests that asset price surges are most dangerous when they are associated with rising financial leverage. The combination of housing price bubbles and credit booms has been the most detrimental of all. This bodes ill for modern leveraged housing price booms, such as in China.

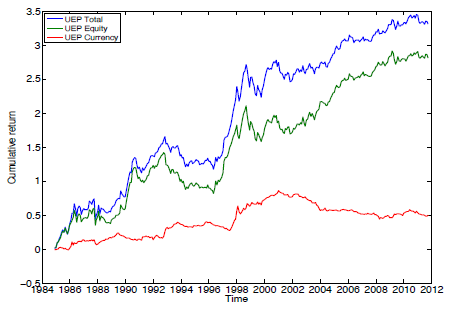

Hints for cross-country equity strategies

An academic paper looks at cross-country relative-value equity strategies. It concludes that [i] relative conventional factors might create alpha and [ii] relative local country equity index returns are uncorrelated with currency returns (and hence the two could be independent value creators).

Why decision makers are unprepared for crises

An ECB working paper explains formally why senior decision makers are unprepared for crises: they can only process limited quantities of information and rationally pay attention to rare events only if losses from unpreparedness seem more than inversely proportionate to their rarity. The less probable a negative event, the higher the condoned loss. Inattention gets worse when managers bear only limited liability.

What markets can learn from statistical learning

Understanding statistical learning is critical in modern markets, even for non-quants. Statistical learning works with complex datasets to forecast returns or to estimate the impact of specific events. The choice of methods is key: they range from simple regression to complex machine learning. Simplicity can deliver superior returns if it avoids “overfitting” (gearing models excessively to specific past experiences). Success must be measured in “out-of-sample” predictive power, after a model has been selected and estimated.

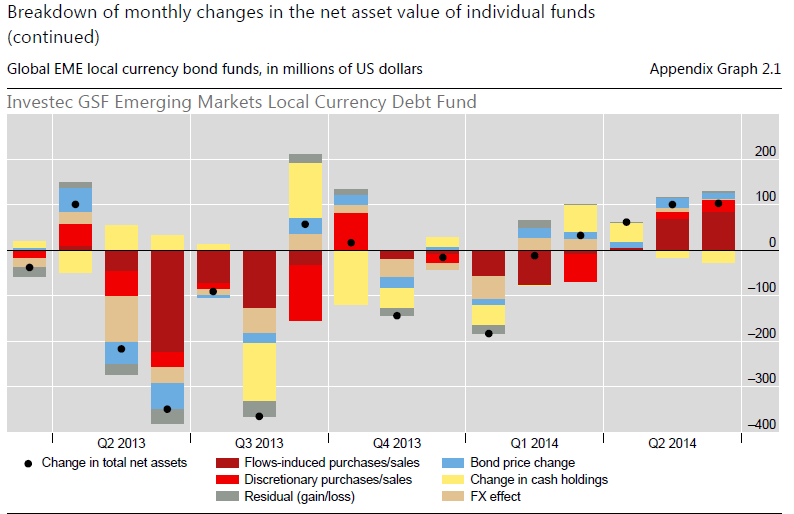

How EM bond funds exaggerate market volatility

A new BIS paper provides evidence that since 2013 fluctuations in EM fund flows and EM bond prices have reinforced each other. Both redemptions and discretionary sales of fund managers have been pro-cyclical. In liquidity-constrained markets this behavior is prone to transmitting shocks and amplifying crises.

China fears: updated basic background

Uncertainty over China’s exchange rate regime has accentuated local and global risks. Within China, fears of currency volatility and depreciation have reinforced capital outflows and asset price weakness. Globally, fears of ‘hard landing’ and financial pressure in China have reignited deflation concerns. Public information does not indicate a sharp slowdown or financial distress, but commentators distrust official data of an economy with great systemic vulnerability.

When is public debt a problem for growth?

A new empirical analysis quantifies the (historic) link between public debt and economic growth. Critical thresholds depend on country features, such as access to financing. Average thresholds might be 60% and 80% of GDP for emerging and developed countries respectively. Importantly, debt dynamics matter more than levels. High debt is less of a drag when it is on a declining trajectory.