China’s economy has long relied on compressed interest rates in conjunction with strict capital controls and a tightly managed exchange rate. A new ADBI paper suggests, however, that modest liberalization and gradual internationalization of the renminbi since 2005 have lessened state control over financial parameters. Inconsistencies and risks of market dislocations have become more evident.

The fall of inflation compensation

A new IJCB article shows that historically [i] inflation expectations had a strong impact on long-term yields and [ii] economic data surprises had a strong impact on inflation expectations. However, the influence of compensation for inflation and inflation risk on U.S. bond yields has faded in the era of non-conventional monetary policy.

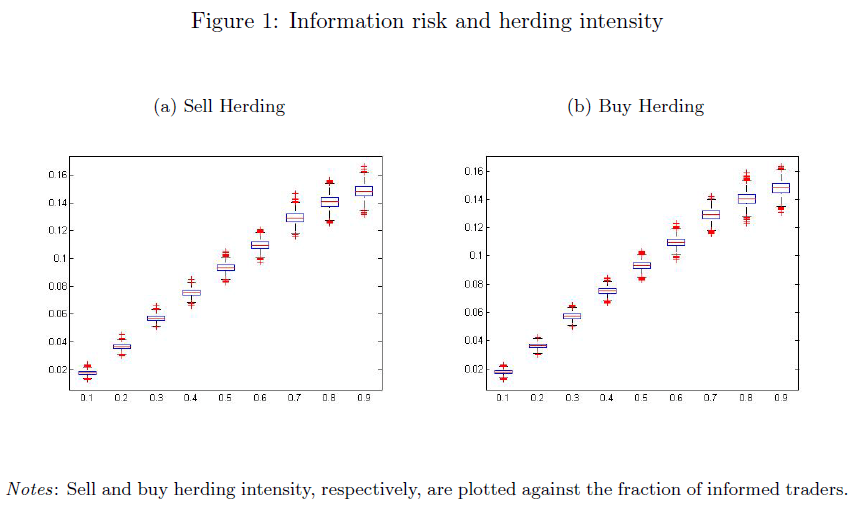

Why and when financial markets are herding

Herding arises from deliberate decisions of informed traders to follow others. It can create inefficiency, dislocations and, hence, profit opportunities. A paper by German academics suggests that herding is the more intense the better informed the market is and the greater the information risk. The paper also finds that both sell-herding and buy-herding increased during the last financial crisis.

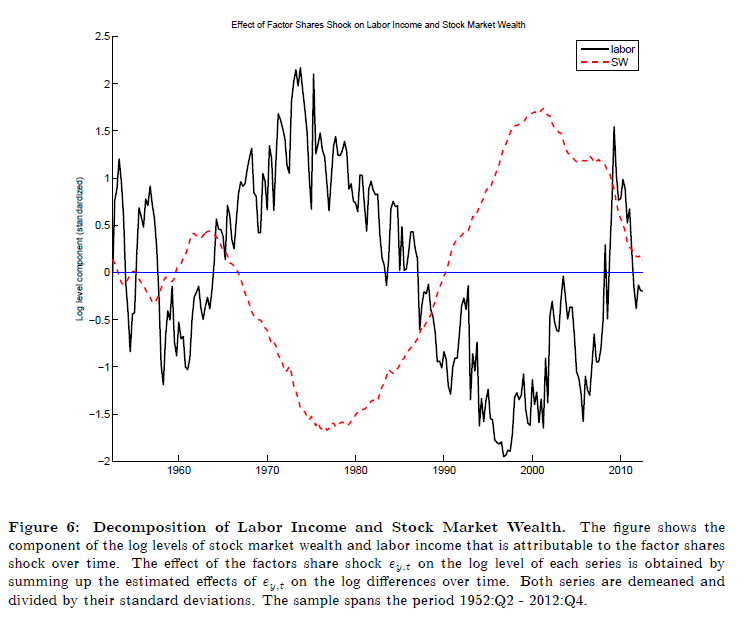

Quantifying underlying causes of equity price changes

A paper by Greenwald, Lettau, and Ludvigson argues that short-term (quarterly) equity price fluctuation arise mainly from changes in risk aversion, while long-term trends (over decades) are heavily influenced by reallocation from labor to capital income. The latter appears to explain all the stock market gains in the U.S. since 1980.

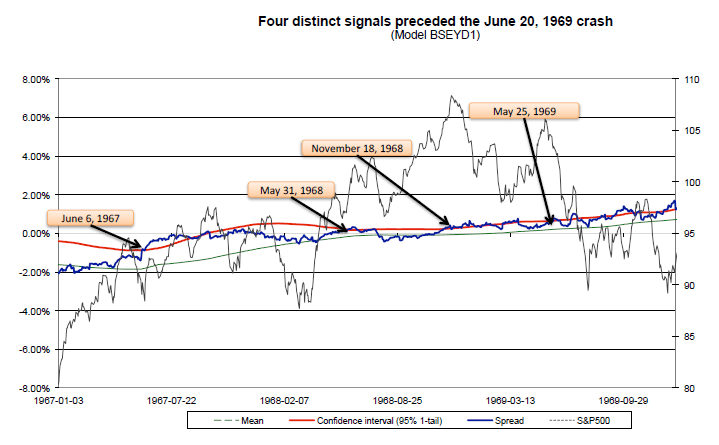

Predicting equity market corrections

Assessing the risk of equity market “crashes”, academic work has focused on price-earnings ratios and bond-stock earnings yield differentials. A recent paper by Lleo and Ziemba provides theoretical reasoning and empirical support for these warning signs.

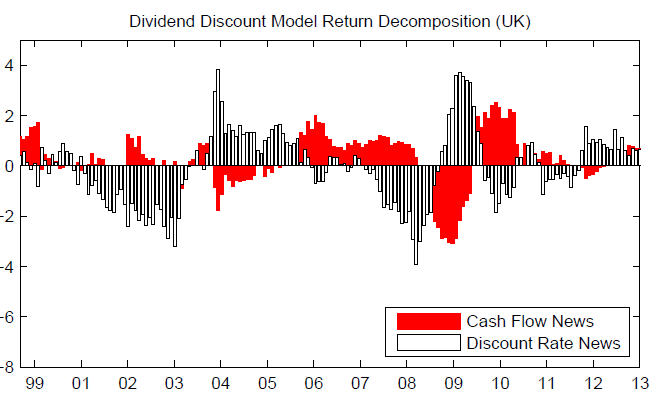

Predicting equity returns

As risk perceptions and risk aversion are fluctuating overtime, so should equity premia. This is a basis for the predictability of equity returns, even in an efficient market. A new Bank of England paper provides evidence that equity returns are indeed predictable by using two classical frameworks: the dividend discount model and multi-indicator vector autoregression.

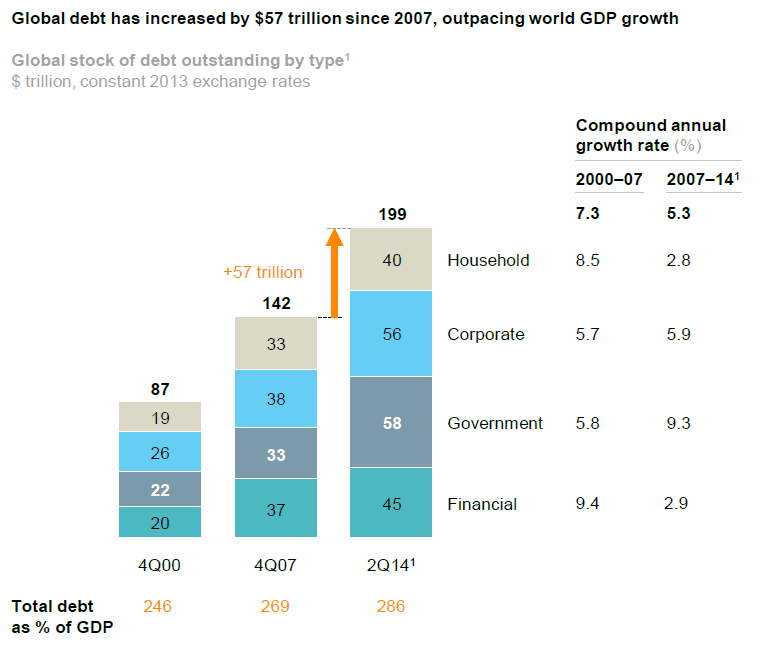

The global debt problem(s)

A new McKinsey report estimates that total debt of households, corporates, and governments has expanded 40% since 2007, reaching a total of 286% of GDP last year. Government debt ratios will be hard to contain through fiscal tightening and economic growth alone. China’s non-financial debt has quadrupled, with credit quality critically dependent on the real estate sector.

An updated guide to ECB non-conventional monetary policy

The ECB now runs one of the most complex monetary policy regimes. Beyond regular liquidity supply, its operating framework features long-term full-allotment refinancing operations, generous collateral acceptance, and a commitment to conditional open-ended interventions in sovereign markets. Subsequently, it has adopted or expanded forward guidance, targeted lending and large-scale outright asset purchases.

The misinterpretation of exchange rate fundamentals

Exchange rates are pulled about by countless factors. There is a tendency to focus on standard fundamentals that happened to coincide with recent exchange rate moves. This has given rise to the “scapegoat theory of exchange rates”. It is nicely explained in a recent Bank of Italy paper. It implies caution in respect to popular “FX themes” in broker research that may lead to distortions, crowded positions and setback risk.

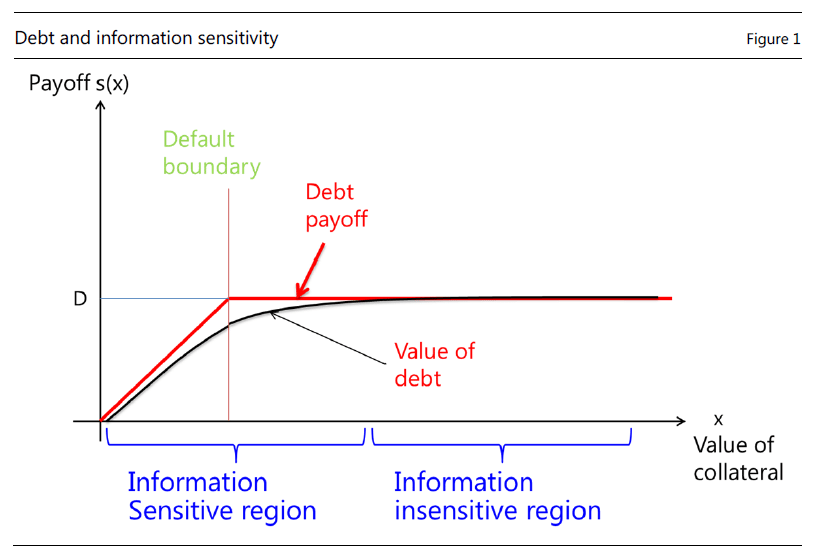

Collateral and liquidity

A new BIS paper illustrates how debt and collateralization create liquidity. In particular, money markets rely on excessive and obfuscated debt collateral to contain information costs. Opacity and “symmetric ignorance” support their smooth functioning. The flipside is that large negative shocks to collateral values inevitably catch markets “uninformed”, disrupting liquidity services.