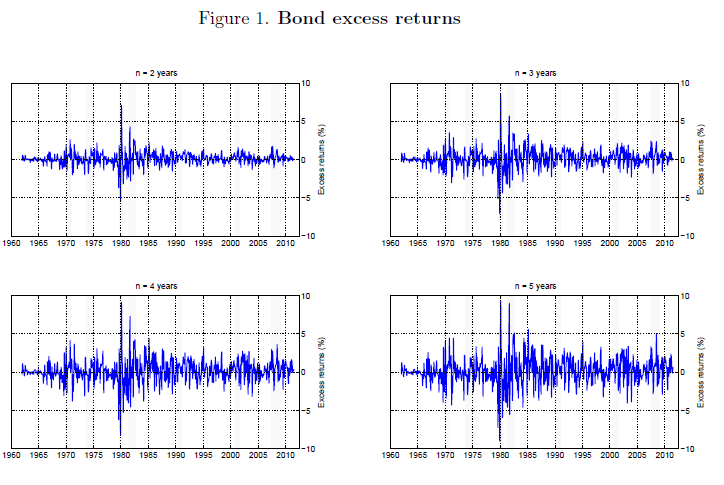

Simple regression is inadequate for predicting bond returns, as the character of rates markets changes fundamentally with economic conditions. In financial modelling terms this calls for time-varying parameters, time-varying volatility, and model uncertainty. A CEPR paper claims that these features can help turning standard forecast factors (forward rates, forward spreads, and macro) into a valuable prediction model.

ECB asset purchases: key points to memorize

The ECB 2015/16 asset purchase program will include sovereign and quasi sovereign debt, ABS, and covered bonds. The envisaged annualized pace of balance sheet expansion should be around 6% of GDP. Pace and size are conditional on inflation expectations and open-ended, subject to restrictions on market size and issuer quality. The absence of full loss sharing could limit benefits for sovereign credit risk.

FX risk and local EM bond yields

A BIS paper shows significant positive correlation of implied FX volatility and local EM bond yields. Empirically the causality runs mostly from FX to bonds, probably because currency risk is a key factor of foreign bond holdings. However, there can also be reverse causality, when FX derivatives are used as proxy hedge in a bond market turmoil. Since FX volatility is stationary, extreme values can indicate value in local EM bonds.

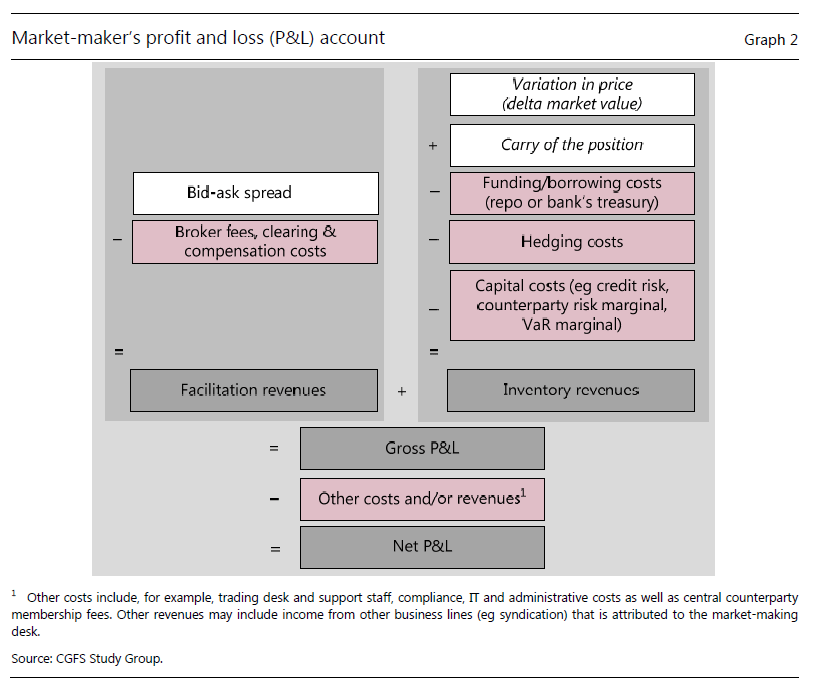

Basics of market liquidity risk

Market liquidity measures the cost efficiency of trading. Liquidity risk refers to the probability that these costs surge when trading is required. Liquidity and liquidity risk are major factors in the long-term performance of trading strategies. The apparent inverse relation between liquidity and expected returns also offers obvious profit opportunities. There are various conceptual solutions for measuring market liquidity timely.

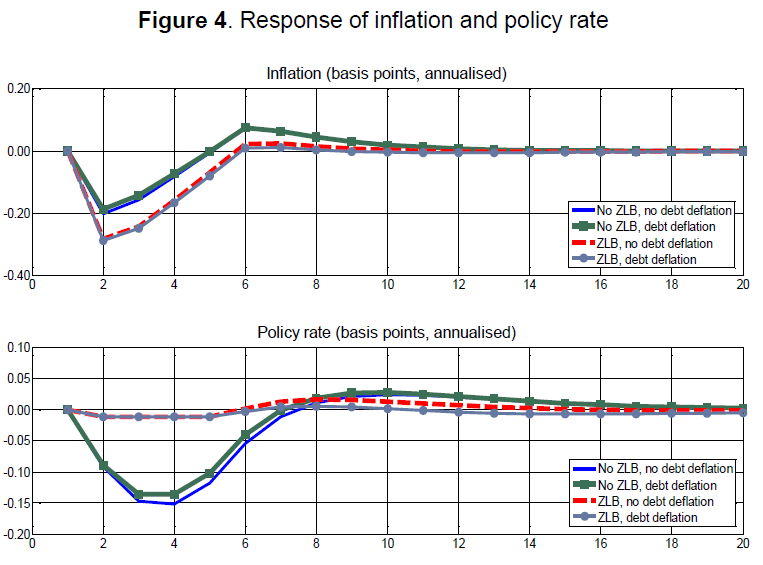

Falling oil prices and the risk for zero-rate economies

A Bank of Italy paper illustrates the detrimental effect of a “negative cost push shock” (for example a commodity price drop) on an economy with low inflation and interest rates close to zero (such as the euro area). In normal times a downside cost shock would boost output. At the zero lower bound for rates, however, it would trigger a contraction, due to rising real rates and debt service.

Updated Summary: Managing systemic risk

Explicit management and research of systemic risk is critical for macro trading. First, it supports timely risk reduction or, alternatively, avoidance of uninformed mechanical liquidations. Second, the calibration of tail risk gives a better idea of value-at-risk. Third, systemic risk research helps the efficient and profitable trading of options and credit default swaps. And fourth, know-how of systemic risk is a valuable currency for information exchange within the investment community.

Variance risk premiums, volatility and FX returns

Variance risk premiums mark the difference between implied (future) and past volatility. They indicate changes in risk aversion or uncertainty. As these changes may differ or have different implications across countries, they may cause FX overshooting and payback. The effect complements the simpler argument that rising currency volatility predicts lower FX carry returns. Academic papers support both effects empirically.

Information inattentiveness of financial markets

Academic research explains macroeconomic information inefficiency with “stickiness” and “signal extraction problems”. Information stickiness means that forecasts cannot be updated continuously and hence markets partly operate on outdated information. Signal extraction problem means that forecasters struggle to separate noise from signal in economic data. The consequence is rational “inattentiveness” of financial markets, offering profit opportunities to those that analyze economic data timely and efficiently.

Bond market liquidity risks

A new CGFS study suggests that [i] bond market makers’ risk tolerance and warehousing have declined and [ii] tighter risk management has augmented pro-cyclicality of liquidity. A gap seems to have opened between more precarious liquidity supply and more voracious liquidity demand, due to rising assets under management at funds that allow daily redemptions.

Updated summary: Government finances and systemic risk

With public debt ratios at their highest levels in two centuries, financial repression has become inevitable, representing the single viable alternative to default. Moreover, global fiscal tightening is still far from complete. Fiscal restriction will probably diminish in coming years if economic growth is exceeding real interest rates, but may come back with a vengeance if not.