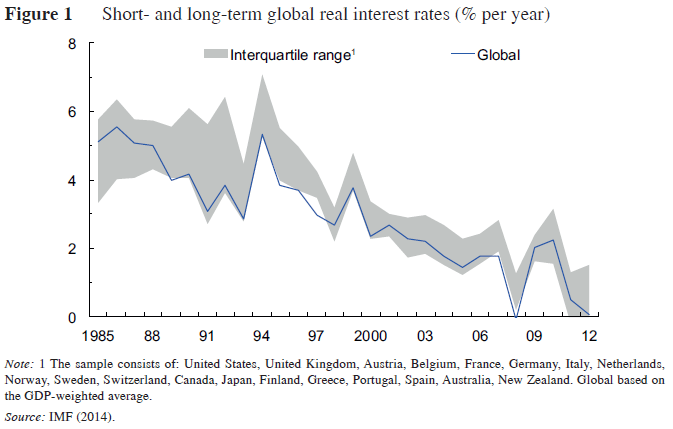

The dangerous slide in global real interest rates

Size, risks and regulation of shadow banking

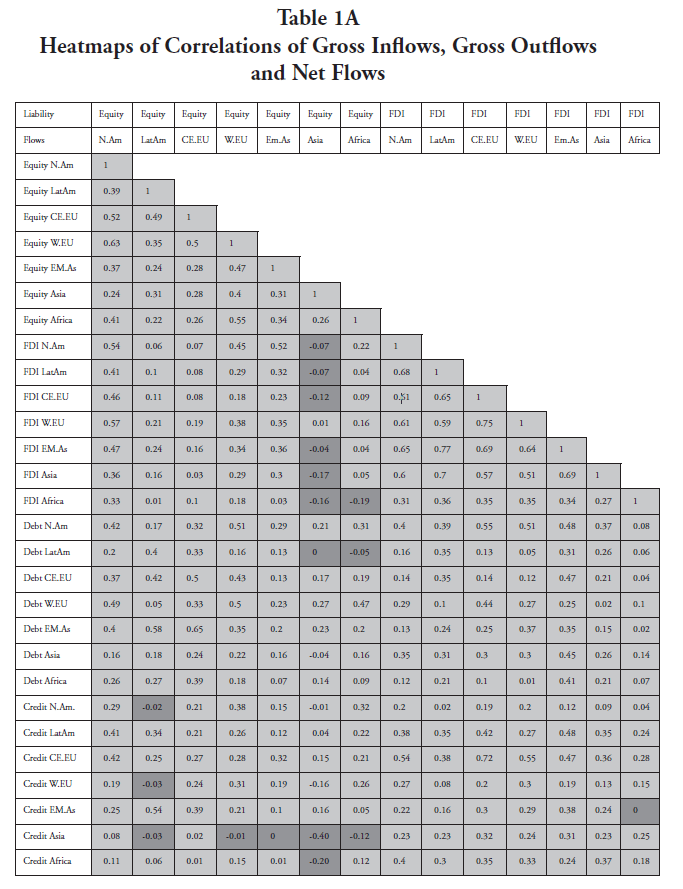

The power of global financial cycles

Summary: Macro information efficiency and investment strategies

Markets are not efficient in respect to macroeconomic information, because both research and strategy development are expensive. As a result, there is ample scope for value generation based on researching fundamental valuation gaps, detecting implicit subsidies, and tracking the setback risk to popular strategies. Increased macro information efficiency benefits both investors and economies at large.

The ECB’s quantitative and qualititative easing

The ECB has introduced a set of new policies that emulate quantitative and qualitative easing. Key measures are targeted long-term repo operations, asset-backed securities purchases, and covered bond purchases. The total net balance sheet expansion is expected to be at least 8% of euro area GDP over two years. Additional asset purchase programmes for corporate and sovereign bonds are possible in order to secure sufficient accommodation and to respond to contingencies.

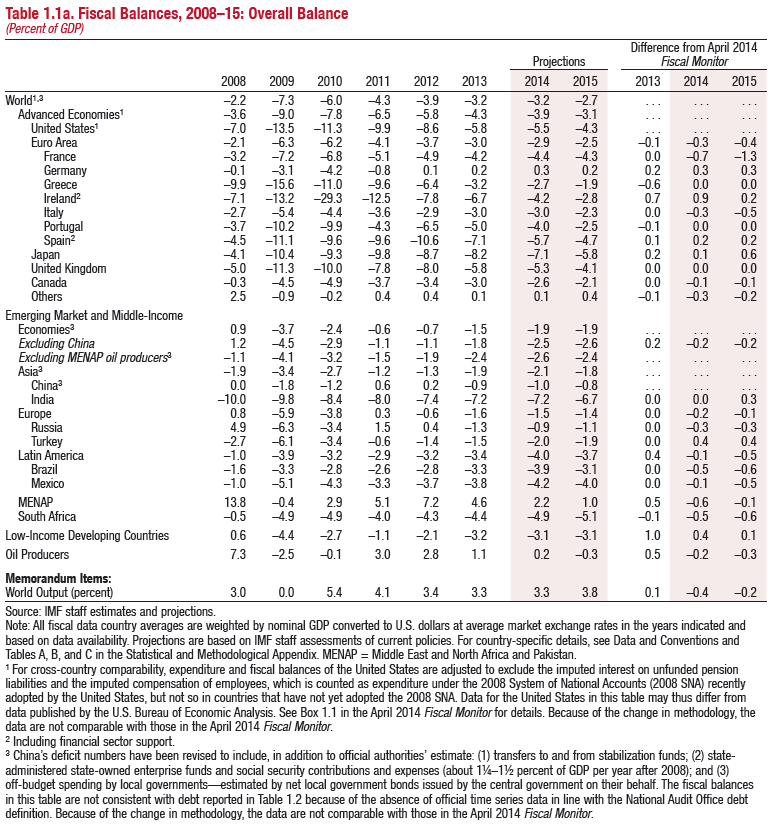

Global public finances: basic facts and numbers

The recent IMF fiscal monitor shows that advanced countries’ government deficit ratios have continued to narrow, due to fiscal tightening and – in some countries – better economic growth. However, public sector debt has inched up further and more restrictive fiscal policies will be required at some time in the future. Also, emerging market public finances have weakened.

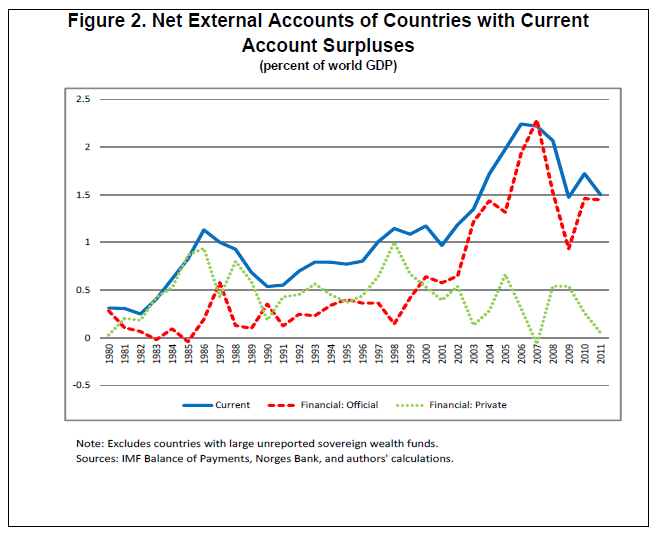

Official flows and consequences for FX markets

A new IMF paper shows empirically that official currency interventions affect external imbalances and, by implication, exchange rate misalignments. There is a short-term flow impact, which is strongest when capital mobility is low. And there is a medium-term portfolio balance impact, which is strongest when capital mobility is high. Both effects are intuitive and offer lessons for FX trading strategies.

Self-fulfilling and self-destructing FX carry trades

When foreign exchange trading meets inflation-targeting self-fulfilling investment strategies are possible. A technical paper by Plantin and Shin shows that positive FX carry encourages capital inflows that reduce inflation and allow monetary policy to condone a domestic asset market boom. Thereby FX carry strategies create their own implicit subsidy and self-validating flows. Conversely, a reversal of such flows is self-destructing.

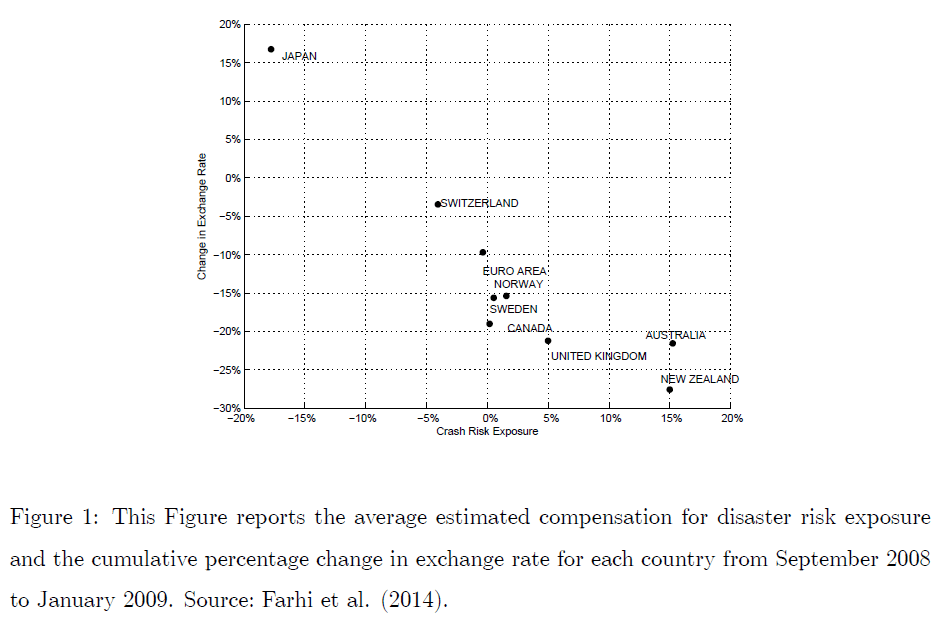

Disaster risk and currency returns

A paper by Farhi and Gabaix explains how fear of global crisis leads to outperformance of risky versus less risky currencies. Carry trades have worked historically, because high risk premia conditioned both high interest rates and subsequent revaluation. As a practical conclusion, gaps between perceived risk (often based on historical variances and correlation) and actual fundamental risk (as indicated by fundamental macro factors) are key value generators in FX strategies.

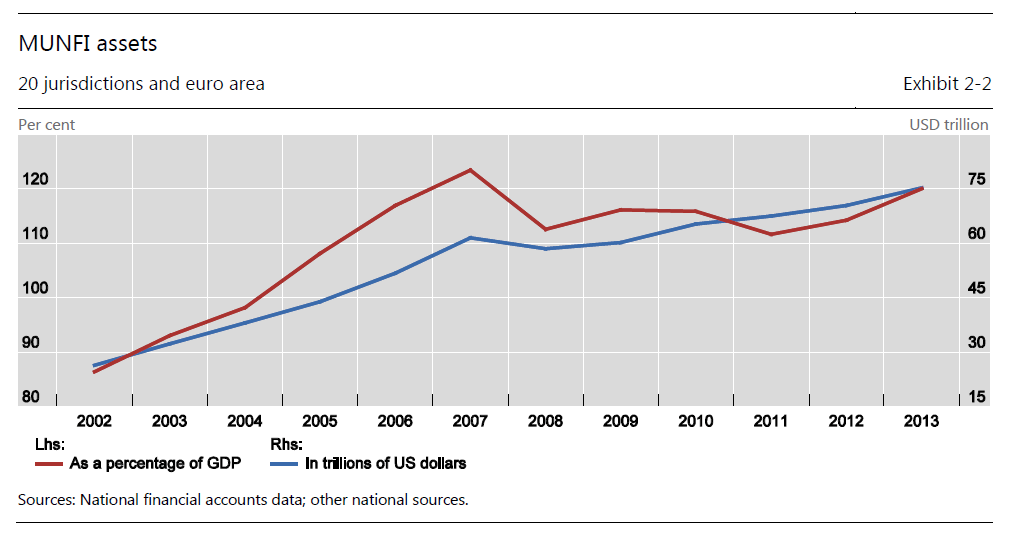

Updated summary: Shadow banking and asset management

Easy monetary conditions and tighter regulation for banks naturally encourage risk transformation and liquidity creation outside the banking system. Institutional asset managers are key agents of that development. As such shadow banking relies on collateral value rather than external backstops it can make the financial system more pro-cyclical and vulnerable. The size and herding incentives of large asset managers could reinforce excesses.