A new BIS paper illustrates how debt and collateralization create liquidity. In particular, money markets rely on excessive and obfuscated debt collateral to contain information costs. Opacity and “symmetric ignorance” support their smooth functioning. The flipside is that large negative shocks to collateral values inevitably catch markets “uninformed”, disrupting liquidity services.

Holmstrom, Bengt (2015), “Understanding the role of debt in the financial system”, BIS Working Papers No 479, January 2015

http://www.bis.org/publ/work479.pdf

The below are excerpts from the paper. Emphasis and cursive text have been added.

The link between credit and liquidity

“The paper presents a perspective on the logic of credit markets and the structure of debt contracts that highlights the information insensitivity of debt. This perspective explains among other things why opacity often enhances liquidity in credit markets and therefore why all financial panics involve debt.”

“Money markets are fundamentally different from stock markets…Stock markets are in the first instance aimed at sharing and allocating aggregate risk. To do that effectively requires a market that is good at price discovery…But the logic behind transparency in stock markets does not apply to money markets. The purpose of money markets is to provide liquidity for individuals and firms. The cheapest way to do so is by using over-collateralised debt that obviates the need for price discovery. Without the need for price discovery the need for public transparency is much less.”

What we can learn from pawn shops

“The pawn shop [is] one of the oldest providers of liquidity. The earliest documents on pawning date back to the Tang dynasty in China (around 650 AD)… The borrower brings to the pawn shop items against which a loan is extended. The pawn shop keeps the items in custody for a relatively short (negotiable) term, say one month, during which the borrower can get back the item in return for repayment of the loan. It sounds simple, but it is a beautiful solution to a complex problem. The beauty lies in the fact that collateralised lending obviates the need to discover the exact price of the collateral… the parties do not have to agree on the value [of the pledged object]…The right to redeem…at the same price at a later date, hopefully when the borrower’s liquidity problem has passed, reduces bargaining costs. The information needed to reach an agreement on the price of the watch (the loan) is relatively small.”

How repurchase agreements compare to pawn brokering

“Today’s repo markets, which play such a prominent role in shadow banking… are close cousins of pawn brokering with similar risks for the parties involved…In a repo the buyer of the asset (the lender) bears the risk that the seller (the borrower) will not have the money to repurchase the asset and just like the pawnbroker, has to sell the asset in the market instead. The seller bears the risk that the buyer of the asset may have re-hypothecated (reused) the posted collateral and cannot deliver it back on the termination date. In today’s repo markets repo fails on both sides are relatively rare, but they happen, especially in times of stressed markets.”

“There is one significant functional difference between pawning and repo. In pawning the initiative comes from the borrower who has a need for liquidity. In repo the motive is often the opposite: someone with money wants to park it safely by buying an asset in a repo.”

Why symmetric information is essential for liquidity creation

“The purpose of money markets is to provide liquidity. Money markets trade in debt claims that are backed, explicitly or implicitly, by collateral. Often the collateral is itself debt.”

“People often assume that liquidity requires transparency, but this is a misunderstanding. What is required for liquidity is symmetric information about the payoff of the security that is being traded so that adverse selection [the apparent information advantage of sellers over buyers] does not impair the market. Without symmetric information adverse selection may prevent trade from taking place or in other ways impair the market…Trading in debt that is sufficiently over-collateralised is a cheap way to avoid adverse selection. When both parties know that there is enough collateral, more precise private information about the collateral becomes irrelevant and will not impair liquidity…Obfuscation may be beneficial. When neither side has an informational advantage to start with, the market will be free of fears of adverse selection and therefore very liquid.”

Why debt is the optimal collateral

“Debt is the best collateral, because the value of debt is also least sensitive to public information. Its value varies less than any other contract with the same initial expected value…It is optimal to buy debt as collateral to insure against liquidity shocks tomorrow and it is optimal to issue debt against that collateral tomorrow…This provides a strong reason for using debt as collateral in the shadow banking system.”

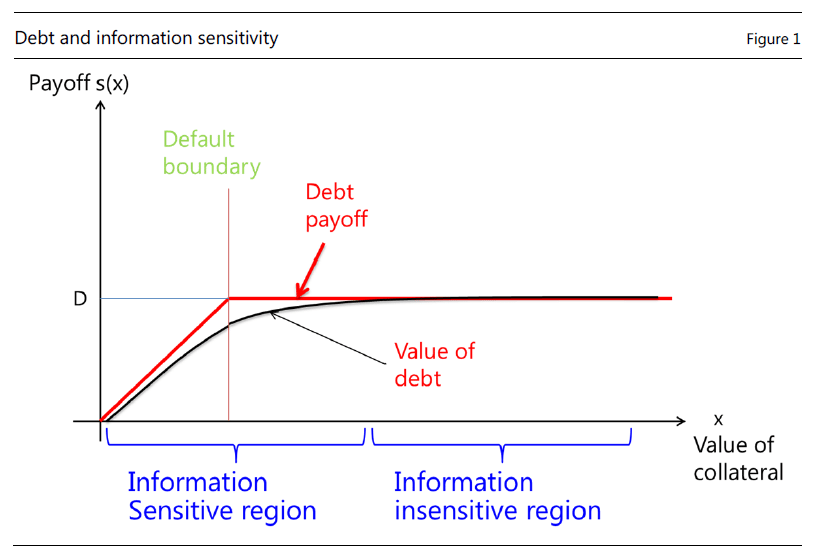

“Figure 1 [draws] in red the payoff of a collateralised debt contract at the time of expiration…Before the date of expiration, the value of the debt contract (to the lender) is less than at expiration, because of the risk of default. This is represented by the black line…debt minimises the cost of price discovery. If one were to write a contract that instead of having a flat part like debt would be strictly increasing in [collateral value] like a share of equity then the execution of such a contract would be a lot more expensive since it would always require an assessment of the payoff at termination.”

“On the other hand, if the distribution is concentrated closer to the kink of the hockey stick [in the above chart], it may pay the buyer to acquire information about underlying collateral of debt before buying; debt has become information-sensitive.”

Why debt is also prone to financial panic

“Because debt is information-insensitive as just discussed, traders have muted incentives to invest in information about debt. This helps to explain why few questions were asked about highly rated debt: the likelihood of default was perceived to be low and the value of private information acquisition correspondingly small.”

“Over-collateralised debt, short debt maturities, reference pricing, coarse ratings, opacity and “symmetric ignorance” all make sense in good times and contribute to the liquidity of money markets. But there is a downside. Everything that adds to liquidity in good times pushes risk into the tail. If the underlying collateral gets impaired and the prevailing trust is broken, the consequences may be cataclysmic.”

“Panics are information events…Figure 3…represents the residuals from fitting a complex forecasting model to data on prices of bilateral trades in AA-rated tranches of subprime home equity loans over the period August 2006–January 2008….In June 2007, two Bear Stearns Funds, heavily exposed to subprime home equity loans, were besieged by investors and collapsed. Before the collapse investors appear to have had a shared view of pricing….Once news about the troubles at the two Bear Stearns Funds surfaced…everything changed. The scatter suggests that private information became relevant in the sense that everyone tried to make the best of their understanding of the situation, based on their experience and expertise. The event shows that significant new public information caused beliefs to diverge rather than converge to a common, lower price level.”

“Debt and institutions dealing with debt have two faces: a quiet one and a tumultuous one…The shift from an information-insensitive state where liquidity and trust prevails because few questions need to be asked, to an information-sensitive state where there is a loss of confidence and a panic may break out is part of the overall system: the calamity is a consequence of the quiet.”