A paper by Farhi and Gabaix explains how fear of global crisis leads to outperformance of risky versus less risky currencies. Carry trades have worked historically, because high risk premia conditioned both high interest rates and subsequent revaluation. As a practical conclusion, gaps between perceived risk (often based on historical variances and correlation) and actual fundamental risk (as indicated by fundamental macro factors) are key value generators in FX strategies.

Farhi, Emmanual and Xavier Gabaix (2014), “Rare Disasters and Exchange Rates”, Harvard University Working Paper, October 2, 2014

http://scholar.harvard.edu/farhi/publications/rare-disasters-and-exchange-rates-0

On further evidence for carry as premium for shock correlation view post here.

The below are excerpts from the paper. Emphasis and cursive text have been added.

A suitable model

“We propose a new model of exchange rates, based on the hypothesis of Rietz (1988) and Barro (2006) that the possibility of rare but extreme disasters is an important determinant of risk premia in asset markets…Overall, the model explains classic exchange rate puzzles and more novel links between options, exchange rates and stock market movements.”

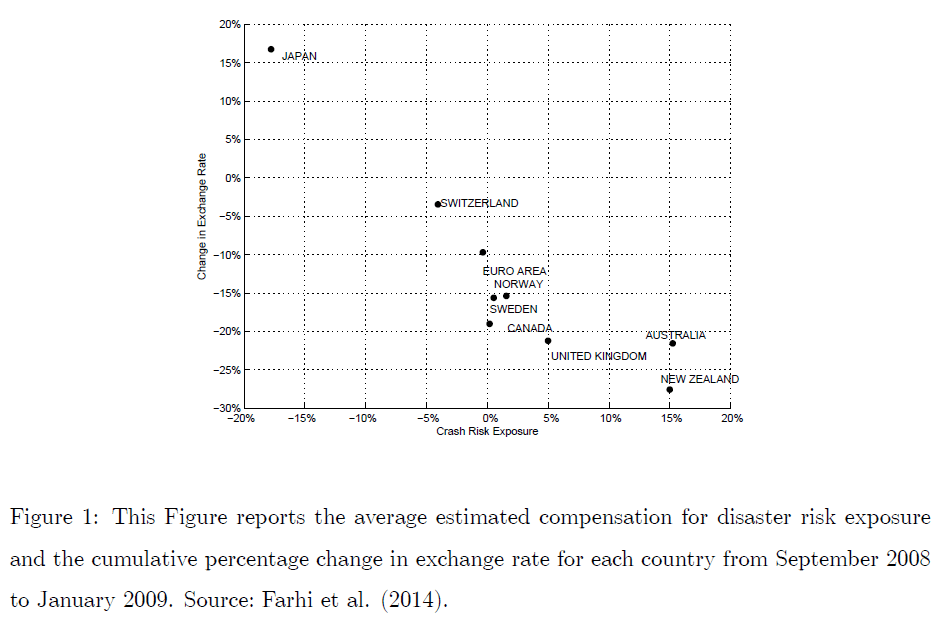

“In the model, at any point in time, a world disaster might occur. Disasters correspond to bad times – they therefore matter disproportionately for asset prices despite the fact that they occur with a low probability. Countries differ by…how much their exchange rate would depreciate if a world disaster were to occur. Because the exchange rate is an asset price whose risk affects its value, relatively riskier countries have more depreciated exchange rates.”

“The probability of world disaster as well as each country’s exposure to these events is time varying. This creates large fluctuations in exchange rates, which rationalize their apparent ‘excess volatility’…Changes in beliefs about disasters translate into meaningful volatility.”

How disaster risk explains currency trajectories

“Relatively risky countries also feature high interest rates, because investors need to be compensated for the risk of exchange rate depreciation in a potential world disaster. This allows the model to account for the forward premium puzzle. Indeed, suppose that a country is temporarily risky: it has high interest rates, and its exchange rate is depreciated. As its riskiness reverts to the mean, its exchange rate appreciates. Therefore, the currencies of high interest rate countries appreciate on average.”

“[Conversely] safe haven countries can borrow at low interest rates and have an appreciated currency…This is a compensation for disaster risk, not default: investors are willing to lend to Switzerland at low interest rates, because the Swiss exchange rate will appreciate relative to Brazil’s in a disaster.”

“The expected return of the carry trade between two countries is equal to…the [negative] difference in their resilience [to global disasters].”

“Empirically, there is no correlation between movements in the stock market and the currency of a country. However, the most risky currencies have a positive correlation with world stock returns, while the least risky currencies have a negative correlation…The economics is as follows: when world resilience improves, stock markets have positive returns, and the most risky currencies appreciate vis-a-vis the least risky currencies.”

How to identify high disaster risk premia

“Investors are willing to pay a high premium to insure…against the risk that this exchange rate depreciates in the event of a world disaster. A country’s risk reversal [a put option for one strike price combined with a call options for a higher strike price] is therefore a reflection of its riskiness.”

“Accordingly, the model makes four predictions regarding these put premia (“risk reversals”). First, investing in countries with high risk reversals should have high returns on average. Second, countries with high risk reversals should have high interest rates. Third, when the risk reversal of a country goes up, its currency contemporaneously depreciates. These predictions…are broadly consistent with the data.”