A Bank of Italy paper illustrates the detrimental effect of a “negative cost push shock” (for example a commodity price drop) on an economy with low inflation and interest rates close to zero (such as the euro area). In normal times a downside cost shock would boost output. At the zero lower bound for rates, however, it would trigger a contraction, due to rising real rates and debt service.

Neri, Stefano, and Alessandro Notarpietro (2014), “Inflation, debt and the zero lower bound”, Bance d’Italia, Occasional Paper, Number 242, October 2014

http://www.bancaditalia.it/pubblicazioni/qef/2014-0242/QEF_242.pdf

The below are excerpts from the paper. Emphasis and cursive text have been added.

The issue

“This paper analyses the macroeconomic effects of a protracted period of low and falling inflation rates when monetary policy is constrained by the zero lower bound (ZLB) on nominal interest rates and the private sector is indebted in nominal terms (debt-deflation channel). In this scenario, even cost-push shocks that in normal circumstances would reduce inflation and stimulate output are found to have contractionary effects on economic activity…”

The general trouble with lower inflation in low-inflation economies

“In principle, the effects on the real economy of a fall in inflation may be both positive and negative. On the positive side, a lower inflation rate may support real income, just as higher inflation reduces it… The list of negative consequences is, on the contrary, much longer.

- First, by moving the economy (closer) to the zero lower bound on nominal interest rates, a protracted fall in inflation reduces the room for conventional, accommodative monetary policy interventions by the central bank.

- Second, lower inflation can hamper adjustments in the labour market. While a sufficiently high inflation rate facilitates the adjustment of real wages, low inflation may hamper it. This is due to the downward rigidity of nominal wages…

- Third, lower inflation interferes with private sector debt deleveraging… Since debt contracts are usually fixed in nominal terms, a fall in inflation increases the real debt burden for borrowers…and induces the private sector to reduce its amount of debt, leading to a fall in asset prices.

- Fourth, if inflation remains low for too long, inflation expectations may de-anchorfrom the target.”

The specific trouble with negative cost push shocks

“[The paper] illustrates the responses of the economy to a negative cost-push shock to the inflation rate. The nature of the shock is such that it may or may not be accompanied by a fall in economic activity… that shock encompasses consumer price movements that are not related to the output gap but are due, for instance, to the dynamics of energy and commodity prices.

A cost-push shock such as the one considered here drives inflation and output in opposite directions and temporarily modifies the trade-off facing the central bank between stabilizing the inflation rate and closing the output gap. A negative cost-push shock raises real disposable income and allows consumers to buy more goods, resembling a positive supply shock that drives inflation below its steady-state level. In normal circumstances, the central bank can easily contrast the latter development by adjusting the policy rate. When this cannot be done because the ZLB is binding, the debt deflation mechanism may result in a negative reaction of economic activity.”

A simulation

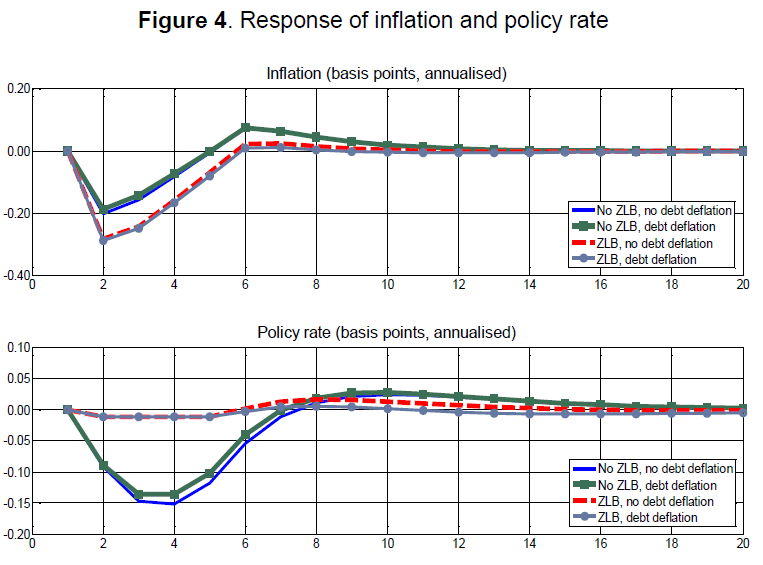

“[The figure below] reports the responses of inflation and the policy rate to a negative inflation shock [in the context of a calibrated macroeconomic model]”

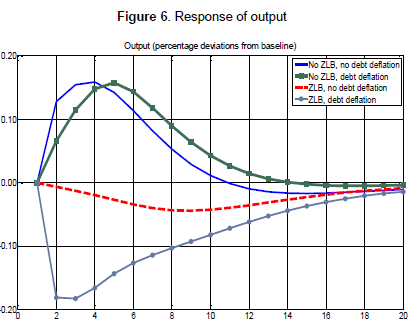

“Given the ZLB, the real interest rate increases after a negative cost-push shock, thus counteracting the expansionary effects on aggregate demand of the decrease in the price level. The debt deflation channel operates as an amplification mechanism: the higher real level of debt and the real repayment cost reduce the disposable income of the borrowers and induce a fall in asset prices and in the value of collateral, resulting in an acceleration of the deleveraging process…”

“A clear message emerges from these simulations. A shock that drives inflation and output in opposite directions when the interest rate is free to react can instead induce a fall in both variables at the ZLB. In addition, the combination of the ZLB with the debt-deflation channel amplifies the contractionary effects on economic activity.”