The recent IMF fiscal monitor shows that advanced countries’ government deficit ratios have continued to narrow, due to fiscal tightening and – in some countries – better economic growth. However, public sector debt has inched up further and more restrictive fiscal policies will be required at some time in the future. Also, emerging market public finances have weakened.

IMF Fiscal Monitor, “Back To Work: How Fiscal Policy Can Help”, October 2014

http://www.imf.org/external/pubs/ft/fm/2014/02/fmindex.htm

The below is verbal summary of key numbers from the report. Text in colons is direct quote.

Basic numbers to memorize

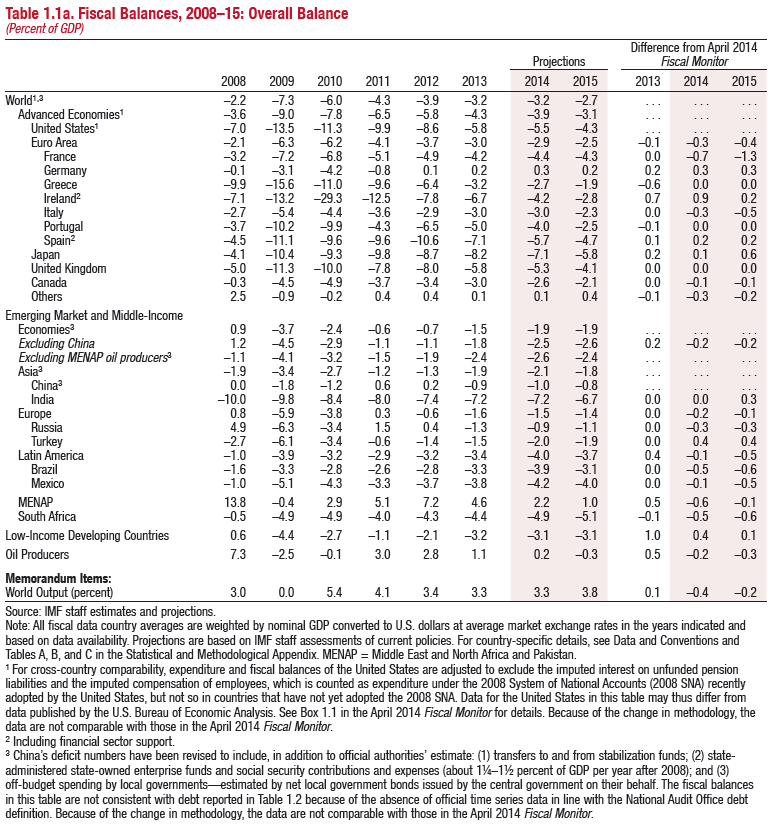

The IMF estimates that the advanced economies’ general government deficithas narrowed further to 3.9% in 2014, from 4.3% in in 2013 and a peak of 9% in 2009, after the great financial crisis. The IMF forecasts the advanced countries’ deficit to decline to 3.1% in 2015. The IMF also estimates that adjusted for the business cycle the developed economies’ 2014 general government budget deficit is yet lower, at 3% of GDP.

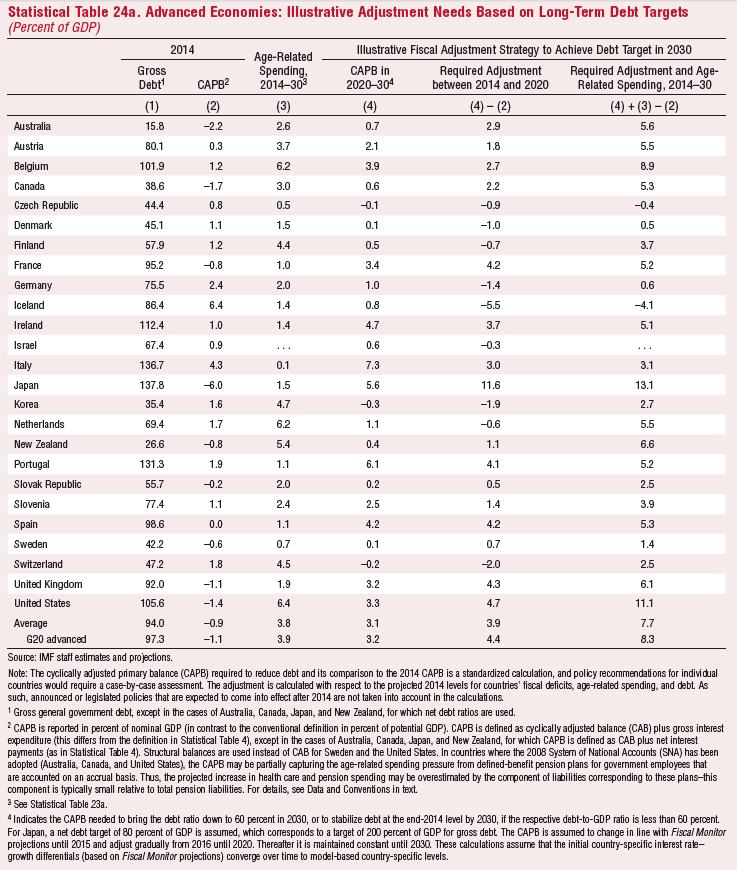

The cyclically-adjusted primary balance (excluding net interest payments) is estimated to have decreased to 2.1% of potential GDP in 2014, from a peak of 5.3% in 2010, pointing to discretionary fiscal tightening of some 3.2% of GDP over just 4 years in the developed world. Moreover, an additional fiscal tightening of 4.4% of GDP would be required until 2020, in order to reach long-term debt targets by 2030. Considering also increases in age-related spending the adjustment would be over 8% of GDP.

The highest deficit countries within the developed world in 2014 are Japan (7.1% of GDP), the U.S. (5.5% of GDP), and the UK (5.3%). Greece with 4.2% is no longer in the top three. Germany is the only major country with a surplus (0.3% of GDP). The average deficit in the euro area has been reduced to just 1.2% of GDP, or more than 4%-points below the United States.

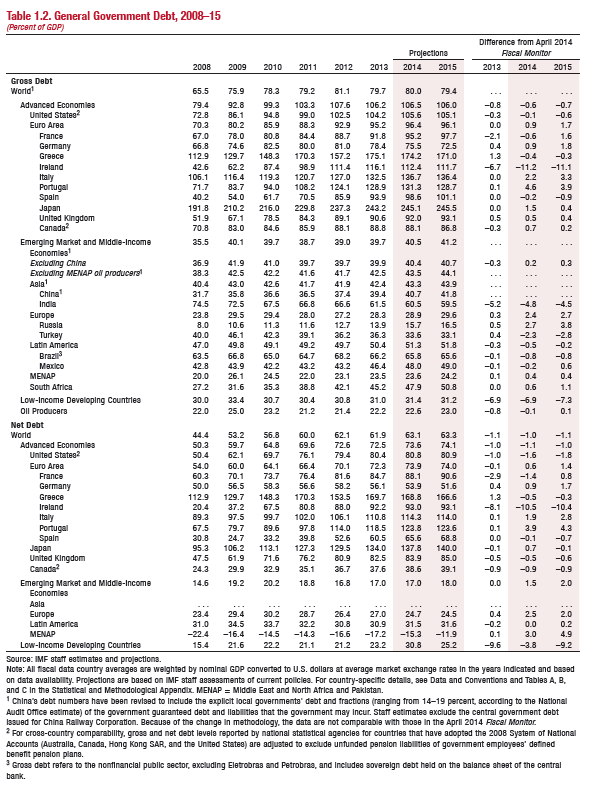

The IMF expects the advanced economies’ general government debt stockincrease to 106.5% of GDP at the end of 2014, from 106.2% at the end of 2013. This compares to a debt level of 79.4% end-2008. The countries with the highest debt ratios would be Japan (245%), Greece (174%), and Italy (137%). The euro area debt stock is estimated at 96.4% of GDP versus 105.6% in the United States.

Meanwhile deficits in emerging markets have been widening. The general government deficit of EM and middle-income countries is estimated to have reached 1.9% of GDP in 2014, from 1.5% in 2013, and a trough of 0.6% in 2011. Adjusted for the business cycle this year’s structural deficit in EM would be a bit higher at 2.2%.

Within the major emerging economies the highest deficits would be recorded in India (7.2% of GDP), South Africa (4.9% of GDP), and Mexico (4.2%) of GDP. China’s is posting a low deficit at 0.9% of GDP, albeit these statistics are contentious (view post here).

The gross government debt stock in the emerging world is estimated to reach 40.5% of GDP at the end of 2014, up from 35.5% in 2008, but roughly stable since 2009. Among the main EM countries, Brazil (66%) and India (61%) have higher debt stocks.

“There is increasing evidence that public contingent liabilities are on the rise in emerging market economies and in many cases already account for several percentage points of GDP. Contingent liabilities are, by definition, difficult to track. Only a few countries follow basic reporting practices or conduct regular monitoring of fiscal risks stemming from them. In China, contingent liabilities amount to more than 14 percent of GDP, and they are also substantial in other countries, including India, Malaysia, and South Africa. Sources of contingent liabilities vary and include off-budget local government borrowing in China, bank recapitalization needs and liabilities of the electricity distribution companies in India, and public enterprise borrowing in South Africa”