Compressed interest rates raise the risk of hitting the zero lower bound. A new theoretical ECB paper shows that even before the ZLB is reached this creates a deflationary bias, as inflation expectations shift lower, real rates rise, and consumption and pricing power decline. To counter this bias central banks would need to accept positive output gaps (tighter labour markets) or even increase their inflation targets.

Nakata, Taisuke and Sebastian Schmidt (2015), “Conservatism and liquidity traps”, ECB Working paper Series, No 1816 / June 2015

http://www.ecb.europa.eu/pub/pdf/scpwps/ecbwp1816.en.pdf

The below are excerpts from the (quite theoretical) paper. Headings and cursive text have been added.

On the related issue of low interest rates and “secular stagnation” view post here.

On monetary policy “risk management” near the ZLB also view post here.

The deflationary bias near the ZLB

“Economists and policymakers have voiced the need to reexamine central banks’ monetary policy frameworks in light of the liquidity trap conditions currently prevailing in many advanced economies. The reason is that the zero lower bound (ZLB) on nominal interest rates severely limits the ability of inflation targeting central banks to stabilize the economy…The ZLB is likely to bind more frequently and that liquidity trap episodes might hit the economy more severely in the future than they have in the past.”

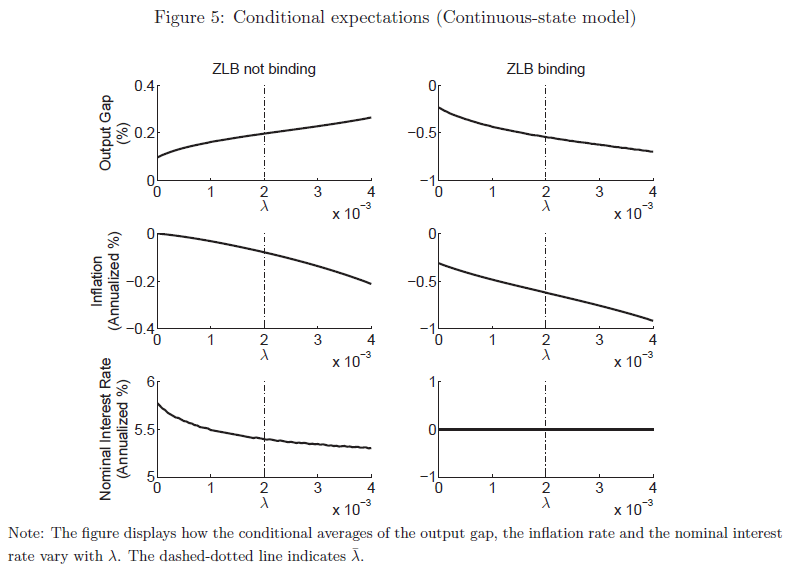

“In an economy with an occasionally binding zero lower bound (ZLB) constraint, the anticipation of future ZLB episodes creates a trade-off for discretionary central banks between inflation and output stabilization. As a consequence, inflation systematically falls below target even when the policy rate is above zero… Subdued inflation rates away from the ZLB in turn exacerbate the decline in output and inflation when the economy is in a liquidity trap.”

“In the low state, the ZLB constraint becomes binding, and output and inflation are below target. In the high state, a positive probability of entering the low state in the next period reduces expected marginal costs of production and leads firms to lower prices in anticipation of future crises events…The possibility of future ZLB episodes reduces inflation expectations in the high state, which can be thought of as a negative cost-push shock…This raises the expected real rate faced by the representative household and gives it an incentive to postpone consumption. The central bank chooses to lower the nominal interest rate to mitigate these anticipation effects. In equilibrium, inflation and output in the high state are negative and positive, respectively, and the non-crisis policy rate is below the natural real interest rate.”

“In the economy in which future shocks can push the policy rate to the lower bound, the anticipation of lower inflation and output gives forward-looking households and firms incentives to reduce consumption and prices even when the policy rate is above the lower bound…The central bank cannot fully counteract these incentives. When the central bank is concerned with both inflation and output stabilization, it faces a trade-off between the two objectives, implying deflation and a positive output gap in those states where the ZLB is not binding…we refer to this undershooting of the inflation target when the policy rate is above zero as deflationary bias.”

Consequences for monetary policy

“A central banker who puts comparatively more weight on inflation stabilization mitigates the deflationary bias away from the ZLB at the cost of a potentially higher output gap… Lower deflation and higher output gaps away from the ZLB also reduce expected real interest rates and increase the expected marginal costs at the ZLB, mitigating deflation and output declines there. This in turn allows the central bank to achieve zero inflation with a smaller positive output gap away from the ZLB, setting in motion a positive feedback loop.”

“Appointing a conservative central banker can mitigate the deflationary bias. An alternative way to reduce the deflationary bias is to appoint a central banker who has a higher inflation target…An increase in the inflation target will reduce the likelihood of hitting the ZLB and therefore reduce the deflationary bias.”