A new BIS paper provides important lessons for EMFX carry trades, using Latin America as a case study. First, FX carry opportunities depend on market structure and regulation. Second, observed carry typically contains a classic interest rate differential and an arbitrage premium that reflects the state of on-shore and off-shore markets. Third, liquidity shortages and FX proxy hedging constitute major setback risks.

BIS Monetary and Economic Department, “Currency carry trades in Latin America”, BIS Papers No 81, April 2015. http://www.bis.org/publ/bppdf/bispap81.pdf

On the basic value proposition of FX carry trades view post here.

On the self-fulfilling and self-destructing potential of FX carry trades view post here.

On the vulnerability of EM local currency asset exposure view post here.

The below are excerpts from the paper. Headings and cursive text have been added.

Basics of the FX carry trade

“Currency carry trades may be defined as investment strategies that borrow low-interest rate currencies (funding currencies) in order to invest in high-interest rate currencies (destination or target currencies), typically with short-term instruments. The currency risk in a currency carry trade is unhedged. Research shows that these trades are profitable over long horizons.”

“Currency carry trades are most frequently transacted in derivative markets (futures, forwards, FX swaps and, to a lesser extent, options)…Activity tends to be concentrated in shorter tenors, of less than six months.”

“The recent literature on carry trades has suggested that the excess returns generated by currencies with high interest rates is a compensation for providing liquidity in the face of the risk of…significant losses…Positive interest rate differentials are associated with negative conditional skewness of exchange rate movements (destination currencies are subject to the risk of a crash).”

The three forms of FX carry trade

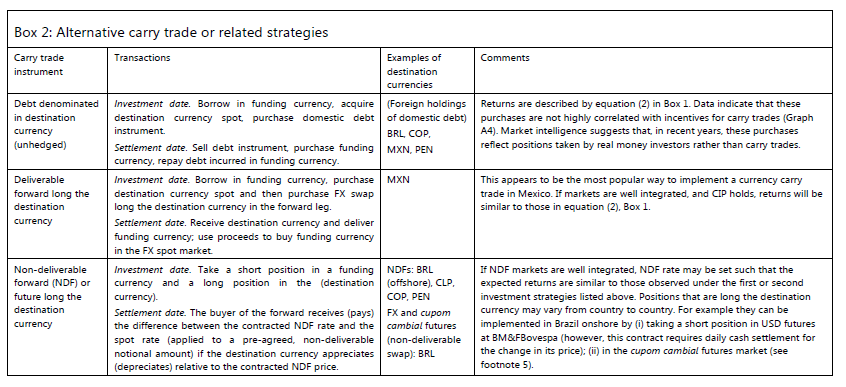

“In Latin America the three main ways to implement carry trades are…

- Purchasing debt denominated in the destination currency:… the investor borrows the funding currency and buys the destination currency in the spot market today. The investor can then earn the destination currency yield by investing in a fixed income security…Foreign purchases of domestic securities appear to have been relevant for carry trades in Brazil, Mexico, Peru and Colombia…Non-residents engaging in onshore transactions would generally have to incur additional costs… in Chile, government regulations limit participation of foreign investors in bonds, and so these are not major vehicles for carry trades.

- Taking a long position in the destination currency in the (deliverable) swap market:… One way to achieve this (observed in Mexico) is to first purchase the destination currency spot, and then to implement a FX swap transaction in which the investor purchases the funding currency spot and the destination currency forward. The return on this strategy involves several transaction costs… Foreign investors in Mexico prefer this kind of strategy because the Mexican peso currency swap market is very liquid, especially in the short term.

N.B. An FX swap agreement can be viewed as FX risk-free collateralised borrowing and lending transaction. - Taking a long position in the non-deliverable forwards (NDF) market:… NDFs may be used to take a short position in a funding currency and a long position in the destination currency by writing a contract so that, on a settlement date, the buyer of the forward receives (pays) the difference between the contracted NDF rate and the spot rate… NDF markets are often offshore…An important advantage of non-deliverables is that there is no need to deliver the notional amount, so that returns can be obtained with a far smaller investment. NDF markets play an important role in foreign exchange market and (any) carry trade activity in Brazil, Chile, Colombia, and Peru.”

Related FX arbitrage premia

“Arbitrage opportunities generally reflect market imperfections that may arise for a number of reasons – including regulatory/prudential requirements that affect the availability of financing in certain markets, capital controls, imbalances between spot and forward markets (due to intervention or other factors), and counterparty risk concerns.”

“Relative returns might be lower in the…more liquid…NDF market rather than the fixed income market…If implied interest rates in derivatives markets are lower, investors may exploit the discrepancy by borrowing (taking a short position) in the funding currency, investing the proceeds in the local debt or money markets and (unlike in the carry trade described earlier) hedging its currency exposure in the forward or FX swap markets… The opposite may happen when reduced liquidity in FX derivatives markets, especially during periods of stress, may result in FX derivative-implied interest rates significantly greater than the ones observed in debt and money markets.”

N.B.: The occurrence of these arbitrage opportunities implies that conventional carry measures may reflect both actual carry and arbitrage premia. Both are relevant for expected returns.

“In Colombia, a regulatory restriction on negative foreign liquid net positions appears to have led to frictions in the forward market that cause deviations from the covered interest parity… the central bank requires that Foreign Exchange Market Intermediaries (FEMIs, mainly banks) do not hold a negative foreign (without derivatives) net position….When the supply of USD in the forward market exceeds the demand, FEMIs accommodating this supply cannot hedge their long USD contracts…Therefore, they have to sell their liquid position in order not to increase their foreign exposure. When the liquid position is low, FEMIs that take the long USD position will do so, but at a …a market price that is lower (cheaper) than that implied by covered interest parity.”

The liquidity shortage problem

“Currency carry trades…are funded mostly by debt. A shock that produces losses can be amplified by so-called liquidity spirals. Speculators facing funding constraints will close out their positions, further undercutting prices, which can lead to further tightening of funding constraints and close-outs.”

“Most importantly, regulation and risk aversion have reduced dealer willingness to warehouse FX risk. Dealer contacts noted that before the crisis they would be more willing to conduct large FX transactions and gradually unwind their risk exposure via offsetting trades. They would also be more willing to take directional views or “prop risk” – e.g. stepping in to buy or sell a currency they viewed as mispriced. The evolution of dealers toward purely transactional, client flow business has weighed on liquidity, leading to smaller transactions that take longer to execute…[According to market participants] buying or selling MXN 200 million used to be a two-minute transaction involving one or two dealers. Now it requires breaking the trade into many pieces and involving “20 different banks”. The transaction now can take anywhere from “two hours to two days”. In this setting USD liquidity risk could in some cases reduce financing for offshore non-deliverable forwards, particularly in those cases where the offshore NDF market is segmented from the onshore market.”

“There may be more systemic implications during periods of stress…some investors expressed concern that during periods of stress, liquidity may be less available than in the past (e.g. due to the more limited presence of banks), it may be difficult to exit positions, and overshooting may be larger than in the past.”

The proxy hedging problem

“Poorer liquidity conditions across EM assets have supported an increase in proxy hedging across countries and instruments via FX trades. In particular, while FX liquidity conditions have deteriorated, participants observed that they are still better than in bond markets. Accordingly, during periods of synchronised currency and fixed income stress, real money investors increasingly “over-hedge” in FX markets, insulating them from FX losses, while absorbing part of their fixed income losses. This is particularly the case in markets that lack liquid interest rate derivative markets). A consequence of this behaviour is to dampen outflows as investors use FX markets to hedge stocks, rather than liquidate positions…. a common currency overlay strategy is to “over-hedge” with highly correlated, lower-cost currencies.”

“Real money investors, e.g. institutional investors such as pension funds, insurance companies and mutual funds or retail investors, now play a larger role in portfolio investment flows to emerging market economies, including in Latin America. The preferences of these investors differ from those of hedge funds or other investors that traditionally engage in carry trades…There is a growing focus on fixed income investments.”