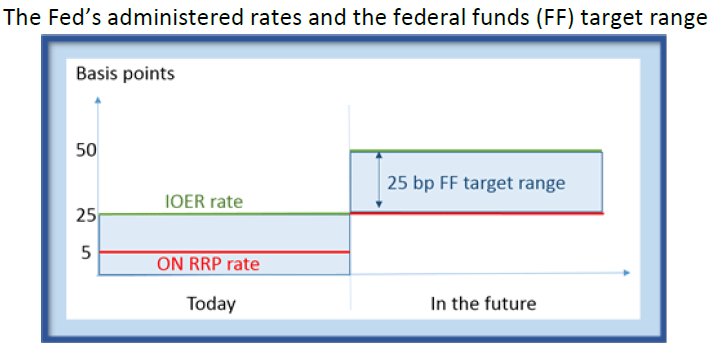

A new “primer” explains how the Fed would tighten policy under current “superabundant liquidity”. Similar to the past, the focus would be on the fed funds rate, not the balance sheet. Unlike in the past, the fed funds target would be a range and pursued by setting in the interest rate on excess reserves (cap) and conducting reverse repo operations (floor).

Ihrig, Jane, Ellen Meade, and Gretchen Weinbach (2015), “Monetary Policy 101: A Primer on the Fed’s Changing Approach to Policy Implementation”, Finance and Economics Discussion Series 2015-047. Washington: Board of Governors of the Federal Reserve System

http://dx.doi.org/10.17016/FEDS.2015.047.

The below are excerpts from the paper. Headings and cursive text have been added.

Why Fed policy implementation had to change

“For many years prior to the financial crisis, the Federal Open Market Committee (FOMC or “Committee”) set a target for the federal funds rate, an overnight interbank borrowing rate, and achieved that target through small purchases and sales of securities in the open market, known as open market operations.”

“Reserve requirements are set by the Federal Reserve and banks hold reserve balances to meet these requirements. At the same time, before the financial crisis, banks generally kept their [reserve] balances to a minimum, in part because the balances earned no return. The combination of Federal Reserve created demand for reserve balances and banks’ desire to limit such balances drove an active interbank market… in which banks borrowed from and lent funds to each other on a daily basis at an interest rate known as the federal funds rate. With reserve balances generally scarce, the Federal Reserve could meaningfully affect the market-determined level of the federal funds rate and keep it close to the FOMC’s target level by announcing the target level of the federal funds rate and making small changes in the supply of aggregate reserves.”

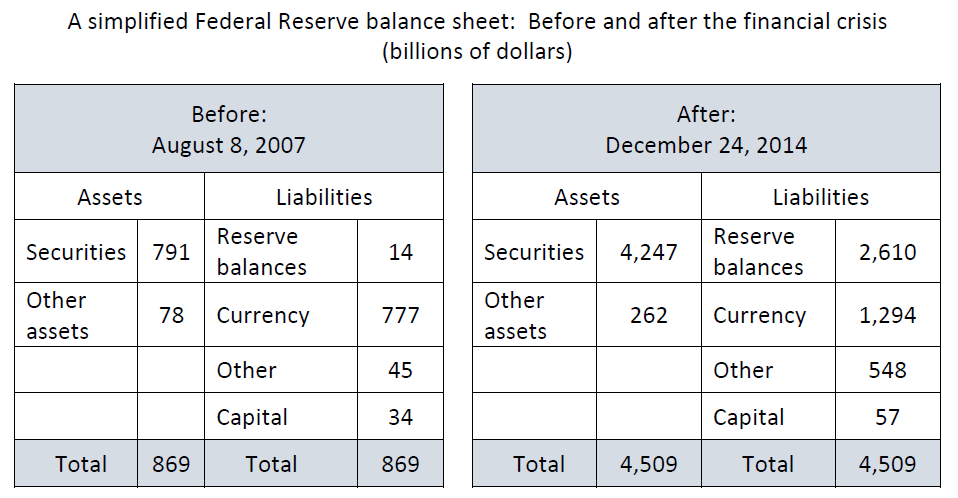

“Prior to the financial crisis, many banks in the United States satisfied their entire reserve requirement with vault cash…The total amount of reserve balances in the banking system hovered around USD15 billion, with excess balances making up less than UD2 billion of this total.”

“To counteract the devastating effects on the U.S. economy of the financial crisis and subsequent Great Recession, the FOMC carried out a series of large-scale asset purchase programs (LSAPs) between November 2008 and October 2014 in which the Fed purchased in the secondary market about USD1,690 billion in Treasury securities, USD2,070 billion in agency mortgage-backed securities (MBS), and $170 billion in debt issued or guaranteed by government agencies.”

“[As a result] reserve balances have grown tremendously since the financial crisis. In late December 2014, reserve balances stood at more than USD2.6 trillion and have remained in that neighborhood since then, with excess balances making up all but about USD90 billion of this total.”

“In an environment with a superabundant level of reserves, the Federal Reserve can no longer rely on small changes in the supply of aggregate reserves to adjust the level of the federal funds rate.”

“[The figure below] compares the market for reserve balances before the financial crisis…with the current environment…There are two key differences…

- The first is that with the Fed paying interest on reserves, the lower portion of banks’ demand curve flattens out near the IOER [interest on excess reserves] rate…

- The second difference is that the supply curve in panel (b) is shown far to the right on the x-axis, representing the superabundant level of reserves in the banking system. As a consequence, the supply curve now intersects the demand curve on the flat portion of the demand curve…With the supply curve in its current position…announcing a higher target level for the federal funds rate and being prepared to conduct an open market operation of the sort that the Fed has traditionally done…will no longer suffice.”

How to hike the fed funds rate in “superabundant liquidity”

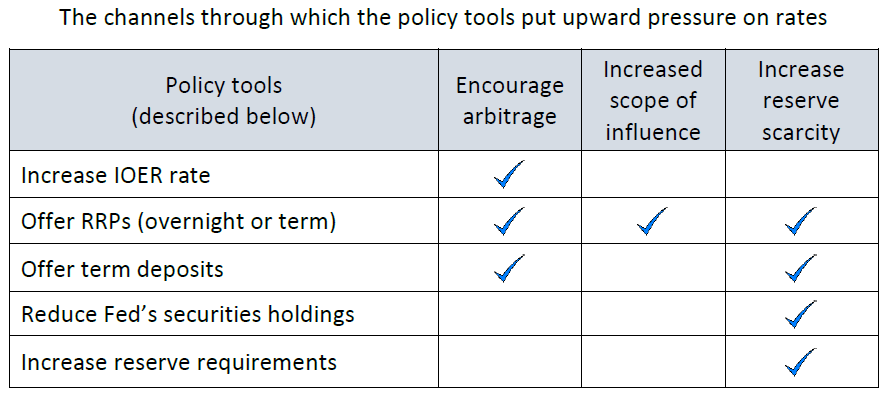

“Three key channels of influence will likely play [a role] in raising short-term interest rates…

- Encourage arbitrage: A policy tool can encourage arbitrage in money markets when it offers an interest rate that acts as a reservation rate, the lowest rate of return that a financial institution would be willing to accept for investing its funds…Generally speaking, financial institutions with access to a given policy tool have an incentive to borrow funds in money markets at rates that are below the interest rate that the Federal Reserve offers on the policy tool and invest the funds in the policy tool, putting upward pressure on money market rates.

- Increased scope of influence: If a policy tool provides a reservation rate to a broader set of financial institutions than banks, we say it has an increased scope of influence in money markets. Access to this tool will narrow the set of institutions that might lend money below the rate earned on the policy tool and put upward pressure on the lowest interest rates in money markets.

- Increase reserve scarcity: Use of the policy tool can increase reserve scarcity by draining reserve balances and moving the level of aggregate reserves closer to its traditional position. If the aggregate level of reserve balances were reduced sufficiently, banks would need to resume borrowing federal funds to meet their demand for reserve balances, leading them to put upward pressure on the market federal funds rate.”

The Fed’s new tools

“[The table below] summarizes the channels through which [the Fed’s contemporaneous] policy tools… aim to increase short-term interest rates.”

- “Rate of interest on excess reserve balances…The FOMC has indicated that the Federal Reserve intends to move the federal funds rate into the target range set by the FOMC primarily by adjusting the rate of interest on excess reserve balances or the IOER rate. The IOER rate encourages arbitrage—it acts as a reservation rate for banks as they make their money market investment decisions…

But…money market rates have remained below the IOER rate because…banks are not the only participants in the federal funds market. Government-sponsored enterprises (GSEs), institutions that also hold reserve accounts at the Fed but are not eligible to earn interest on those balances…These institutions are willing to lend out federal funds at rates that are relatively low…Moreover, because reserve balances are superabundant among banks, nearly all of the federal funds trading reflects borrowing by banks from non-IOER-earning institutions, at relatively low rates, to engage in such arbitrage activity. - Overnight reverse repurchase agreements…The FOMC has indicated that, when the time comes to begin to raise the target federal funds rate, it intends to use an overnight reverse repurchase agreement (ON RRP) facility as needed to help keep the federal funds rate within its target range…ON RRPs have been offered on a daily basis with an offering rate that is pre-announced and can act as a reservation rate…the set of counterparties that are eligible to participate in the Fed’s ON RRP operations is much broader…increasing the sphere of influence that the ON RRP rate has in money markets…In particular, the eligible nonbank institutions, which are unable to earn interest on reserves, may be encouraged to engage in arbitrage activity relative to the ON RRP rate…Such activity has the important effect of providing a floor under the level of money market interest rates and supporting them from below.

- Term reverse repurchase agreements…In addition to conducting RRPs on an overnight basis, the Fed can conduct the same type of transaction with the same set of eligible financial institutions but with the RRP outstanding over a longer time period…In general, term RRPs…drain reserves from the banking system for a longer period of time.

- Term Deposit Facility…The Fed may also choose to offer interest-bearing deposits to banks through its Term Deposit Facility or “TDF.” When a bank elects to place funds in the TDF, the funds are moved out of reserve balances for the life of the term deposit. Thus, the TDF acts to increase reserve scarcity. The TDF also encourages arbitrage as banks compare the yield the Fed offers on a term deposit with other investments of a similar term.”

The Fed’s likely strategy for ‘liftoff’

“The FOMC has chosen an approach to implementing monetary policy that relies primarily on policy tools both to encourage arbitrage and to increase its scope of influence in short-term money markets… The FOMC has indicated that when it begins to remove policy accommodation, it prefers to target the federal funds rate, as it did prior to the financial crisis, instead of affecting longer-term interest rates by actively managing the size and composition of its balance sheet.”

“When the FOMC decides that economic conditions warrant the commencement of the policy normalization process, it will tighten the stance of monetary policy by adjusting the target range for the federal funds rate, a step that some have nicknamed interest rate ‘liftoff.’…The FOMC has also indicated that it plans to continue to set a target range for the federal funds rate that is 25 basis points wide, something it has been doing since December 2008.”

- “The primary policy tool that the FOMC will use to move the federal funds rate into its new target range is the IOER rate; at liftoff, the IOER rate will be set to the top of the new federal funds target range…

- The FOMC will also use an ON RRP facility as a supplementary tool to help to push money market interest rates up from below both by encouraging arbitrage and by having an increased scope of influence in money markets (remember that the Fed can undertake its ON RRP operations with a different set of financial institutions than are eligible to earn the IOER rate). The Fed will offer the ON RRP rate on its daily operations; at liftoff, the ON RRP rate will be set to the bottom of the new target range.”

“The FOMC has said that it may use other supplementary tools if it needs to; this would possibly include term RRP operations and term deposits.”

“The FOMC has said that, at some point after it begins to increase the target range for the federal funds rate, it will reduce the Federal Reserve’s securities holdings in a gradual and predictable manner, primarily by ceasing to reinvest repayments of principal on securities held by the Federal Reserve.”

“The Fed’s securities holdings could decline noticeably once the FOMC decides to end reinvestments… nearly USD700 billion of securities would mature or roll off of the Fed’s portfolio in 2016 and 2017 taken together, comprised of about USD410 billion of Treasury securities and an estimated USD285 billion of agency MBS…Doing so would naturally shift the reserve supply curve gradually to the left, increasing reserve scarcity. Of course, it would take a number of years for the quantity of securities to decline sufficiently to create a meaningful inward shift in the supply curve—that is, one that would be effective in helping to put upward pressure on the federal funds rate.”