Herding arises from deliberate decisions of informed traders to follow others. It can create inefficiency, dislocations and, hence, profit opportunities. A paper by German academics suggests that herding is the more intense the better informed the market is and the greater the information risk. The paper also finds that both sell-herding and buy-herding increased during the last financial crisis.

Boortz, Christopher, Simon Jurkatis, Stephanie Kremer, and Dieter Nautz (2014) : Institutional herding in financial markets: New evidence through the lens of a simulated model, Beiträge zur Jahrestagung des Vereins für Socialpolitik 2014

http://econstor.eu/bitstream/10419/100455/1/VfS_2014_pid_456.pdf

The below are excerpts from the paper. Emphasis and cursive text have been added.

What is herding?

“The theoretical herding literature defines herd behavior as the switch in an agent’s opinion into the direction of the crowd… As herd members ignore their own private information, herd behavior is always informationally inefficient and thus has the potential to distort prices and to destabilize markets.”

N.B.: Other papers emphasize that herding is a deliberate decision to imitate the actions of others. In financial markets with private information herding can be efficient for an individual asset manager, but increases the risks that the market as a whole is inefficient and fragile, particularly in the case of ‘information cascades’. See post here.

“Herd behaviour is self-enforcing while contrarian behavior is self-defeating. Therefore, the destabilizing effects of contrarianism are limited and, thus, only of secondary importance for financial markets.”

How does herding arise?

“Herding stems from information externalities that an observable investment decision of one agent exhibits on subsequent agents’ expectation regarding the investment value. Other microeconomic foundations of herd behavior include reputational concerns.”

“The focus of this paper is on the impact of market stress and information risk on aggregate herding intensity…Information risk, defined as the probability of trading with a counterpart who holds private information about the asset, reflects the degree of asymmetric information.”

How does herding work in theoretical models?

“Traders are either informed traders or noise traders….Informed traders base their decision to buy, sell or not to trade on their expectations regarding the asset’s true value. In addition to the publicly available information…informed traders form their expectations according to a private signal…Noise traders trade randomly, i.e. they decide to buy, sell or not to trade with equal probability…”

“Park and Sabourian (2011) describe herding as a ‘history-induced switch of opinion [of a certain informed trader] in the direction of the crowd’… only informed traders can herd… sell herding intensity in the model is measured as the ratio of herding sells to informed trades.”

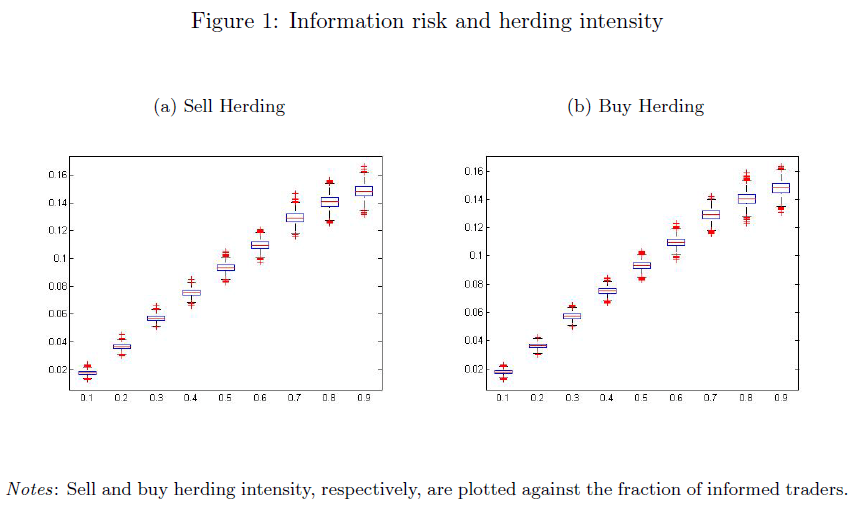

“[Based on model simulations] we obtain two testable hypotheses regarding the impact of information risk and market stress on aggregate herding intensity:

- First, an increase in information risk should result in an increase of both, buy and sell herding intensity… Information risk [is]…the probability that an observed trade was executed by an informed trader. Thus, information risk coincides with…the fraction of informed traders… Intuitively, private information may be easier dominated by the information contained in the history of trades as each preceding trade is more likely to be carried out by an informed type…

- Second, increased market stress should have an asymmetric effect on herding intensity: it should imply a decrease in buy herding intensity but an increase in sell herding intensity… Market stress are typically understood as times of deteriorated economic outlook and increased risk, when markets become more pessimistic and more uncertain…these changes in the distribution of the fundamental value of the asset are reflected in lower expected value and higher variance.”

What is the empirical evidence?

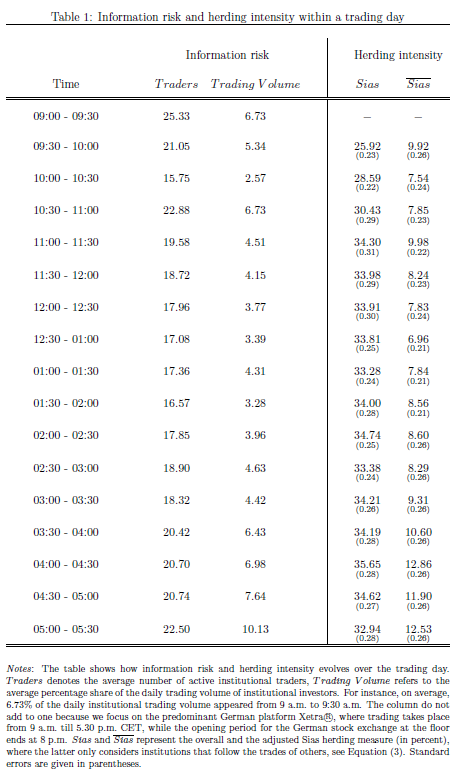

“We contribute…by testing model-based hypotheses using an intra-day, investor-specific data set provided by the German Federal Financial Supervisory Authority (BaFin). The data include all real-time transaction in the major German stock index DAX 30 carried out by banks and financial services institutions. In line with herding theory, the use of intra-day data is particularly appropriate…Private information in financial markets is fast moving and the informational advantage from private signals can only be exploited for short time horizons….The use of investor-specific data is particularly important as we need to directly identify transactions by each trader in order to determine whether an investor follows the observed actions of other traders or her own trades.”

“To assess herding empirically, we employ the herding measure proposed by Sias…[who] proposes a…dynamic approach to test for herding. He investigates whether the accumulation of investors on one side of the market persists over time by measuring the cross-sectional correlation of the share of net buyers over two adjacent time periods.”

“In accordance with our first theory-based hypothesis, our empirical results show that herding intensity increases with information risk. In particular, the analysis of half-hour trading intervals reveals a strong and significant co-movement of trading activity and the herding intensity of institutional traders…we derive our theoretical prediction for the effect…by conducting comparative static analysis for herding intensity with respect to changes in the fraction of informed traders… we use two empirical proxies: the number of active institutional traders and the share of the institutional trading volume.”

N.B.: The empirical support for the role information risk is consistent with other work that emphasizes as slightly different aspect: herding arises where public information is very important (such as before government and central bank announcements) and when privileged information is particularly valuable. View post here.

“However, our results do not suggest an asymmetric impact of market stress on herding intensity. In fact, we find that both, sell as well as buy herding slightly increased in the German stock market during the financial crisis.”

N.B. Other authors have found evidence for herding in a range of FX and equity markets. See post here.

Also a U.S. focused paper suggests that herding in bond markets seems to be stronger than in equity markets. See post here.